Global PMI - special Russia-Ukraine war report

Global growth slows and inflation pressures intensify amid rising economic headwinds

Global economic growth slowed in April and inflationary pressures intensified as the Russia-Ukraine war and lockdowns in China drove increased risk aversion, disrupted supply chains and lifted prices for many commodities, notably energy and food. In this special report we draw on analysis and insights from S&P Global's PMI survey data and its experts from various fields to provide a comprehensive overview of the current situation and its implications in the light of the latest survey findings.

Our macroeconomic forecasting team assesses how the war and latest survey data have altered the economic outlook, policymaking and recession risks. Our industry specialists provide a deeper dive into the effects of the invasion on trade and supply chains, as well as how both new supply disruptions and weakening demand are set to play out in commodity markets, with additional focus on energy and agriculture. We also review S&P Global's unique PMI sector data to highlight how various industries are being affected by the war, with a special focus on the auto market. Finally, our risk experts take a look at how the conflict in Ukraine is likely to play out in the coming weeks.

PMI data show weakest economic growth since June 2020

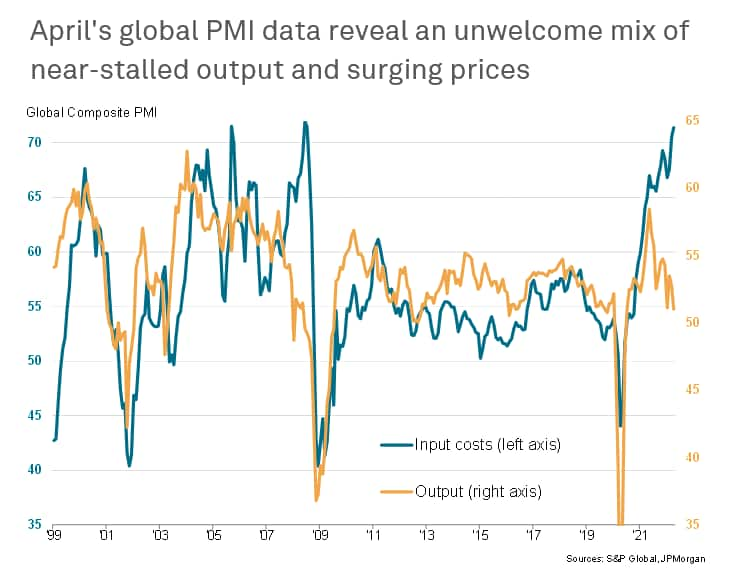

The pace of global economic growth slowed in April to the lowest since the downturn of the second quarter of 2020, according to the latest PMI data compiled for JPMorgan by S&P Global. The survey data reflect information provided by panels of over 30,000 companies in 45 countries and are valued as the earliest indicators of changing economic conditions. The headline PMI fell from 52.7 in March to 51.0 in April, only modestly above the no change level of 50.0 to signal a near-stalling of growth. It was among the lowest readings seen over the past decade.

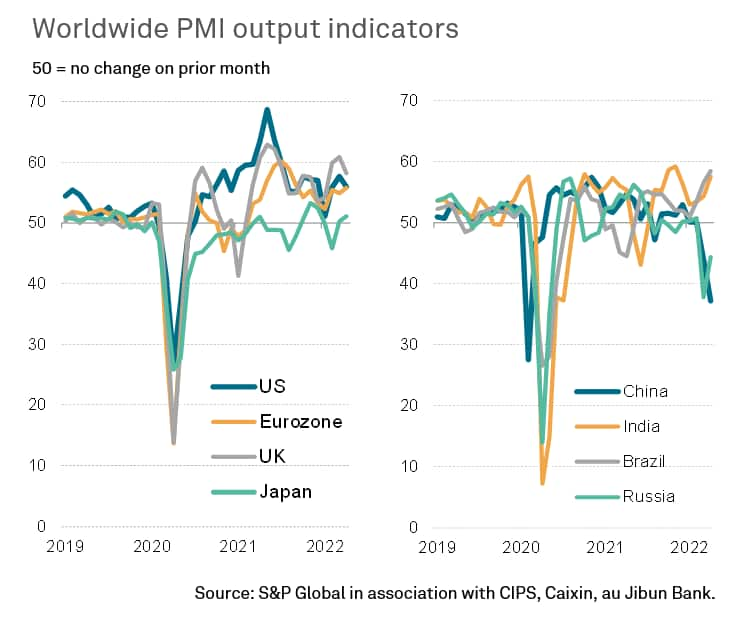

Global growth was dragged lower principally by steep contractions in Russia and mainland China. Barring the initial COVID-19 outbreak, March and April have seen the largest drops in Russian output since the global financial crisis. Both manufacturing output and services activity are falling sharply. China likewise saw a second month of slumping output in both manufacturing and services, with rates of decline accelerating in April to highs exceeded in 18 years of survey history only by the collapse in output suffered in February 2020.

China's slowdown has been the result of COVID-19 containment measures having been tightened in April to the most stringent so far in the pandemic. However, looser covid restrictions in other economies meant growth elsewhere was often resilient, losing only marginal momentum in April on average. The US, Eurozone, UK, India and Brazil in particular all continued to report strong growth.

Supply disruptions and inflation pressures intensify

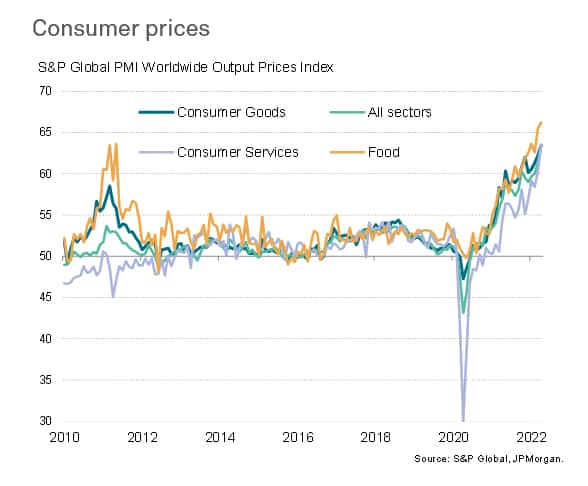

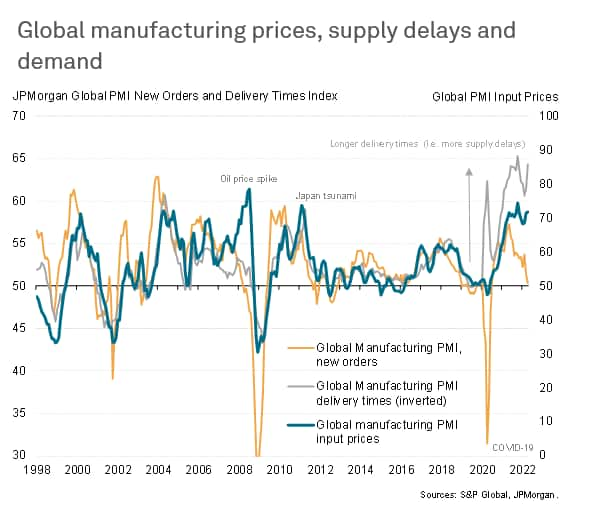

However, the war and new lockdowns in China have worsened existing supply chain and inflation trends, leading to a near-record survey rise in firms' costs and record selling price inflation for goods and services globally in April.

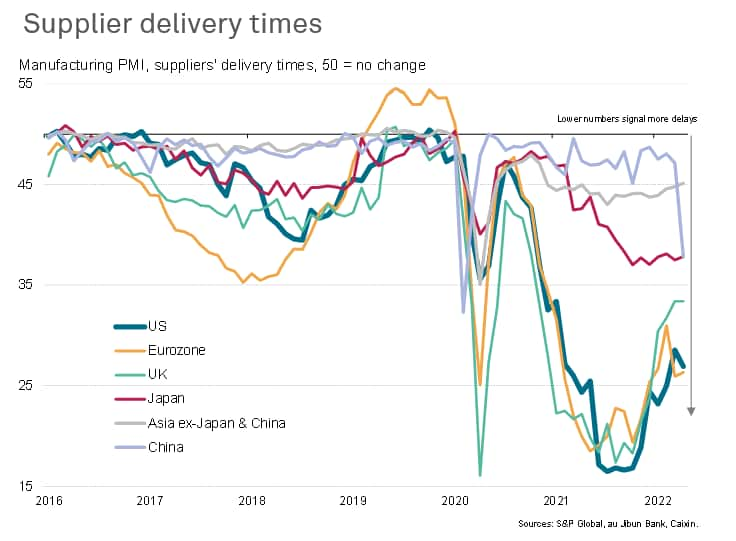

Supply chain stress is gauged via the PMI suppliers' delivery times index. The PMI surveys showed that supplier lead times have lengthened to unprecedented degrees during the pandemic, with 2021 seeing new records being broken month after month in terms of supplier delays. While the opening months of 2022 saw some moderation in the number of reported delays, March and April have seen the supply situation worsen again, linked primarily to the disruptions caused by the Ukraine war and China's shutdowns. The latter is perhaps of the more notable concern for the near-term: China's PMI data have shown a more severe downturn in manufacturing output due to the recent Omicron outbreaks than seen in the initial COVID-19 shutdowns, which has the potential to feed through to further supply delays in coming months.

The supply crisis therefore continues to act as a major support to prices, especially for goods, placing pricing power in the hands of the seller. Russian sanctions amid the Ukraine war meanwhile continue to act as a support to global energy prices, with food prices also elevated by the conflict.

Growth reliant on consumer spending on services

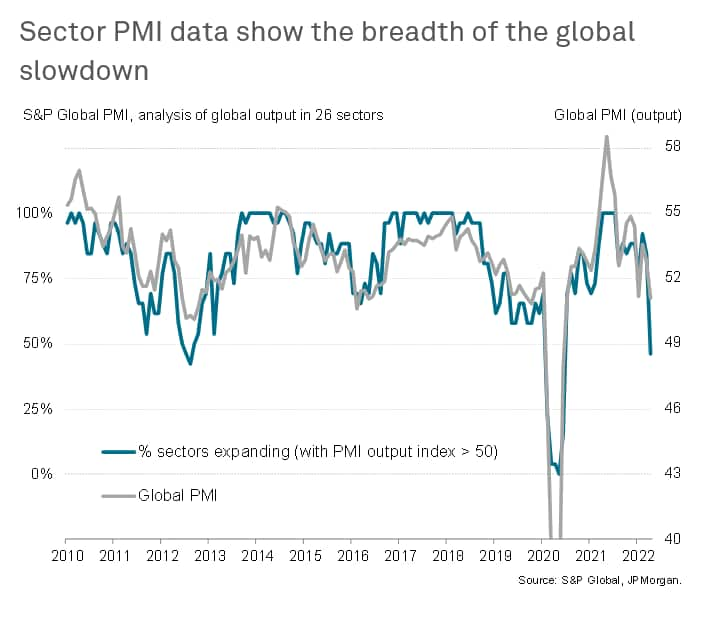

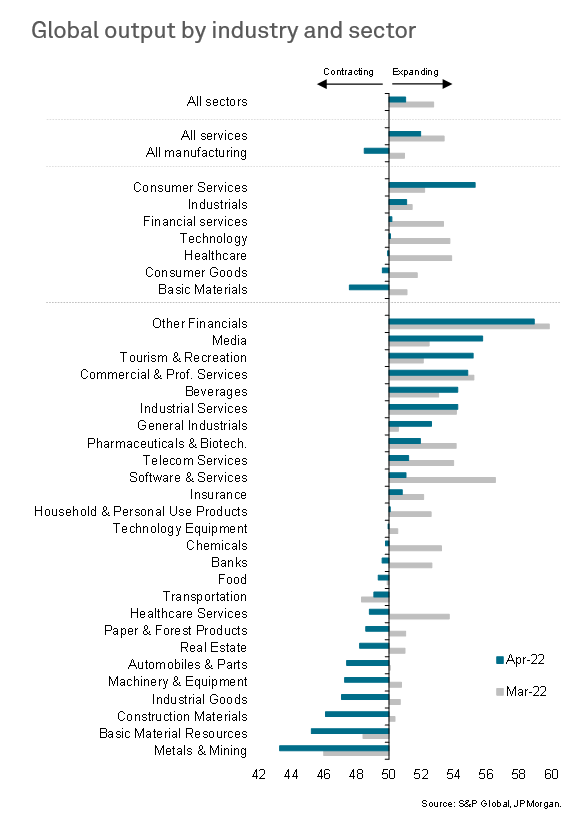

Detailed sector PMI data meanwhile revealed a broadening of both the global economic slowdown and the renewed inflationary pressures evident across industries in April.

With the exception of the downturn seen in early 2020 during the initial phase of the pandemic, April saw more sectors reporting falling output than at any time since 2012. Some 14 of the 26 sectors covered by the PMIs reported falling output in April, up sharply from just four in March.

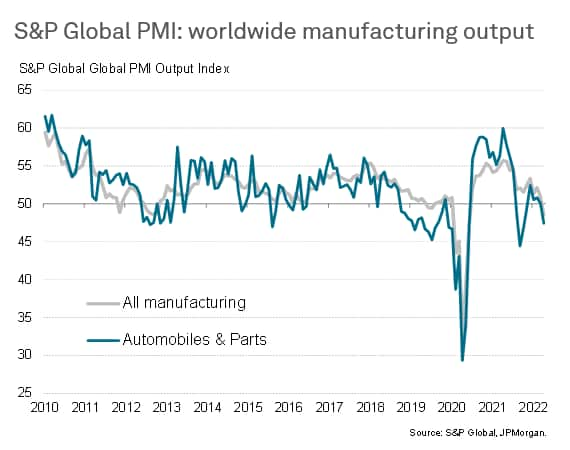

The steepest declines were seen in manufacturing sectors, which as a whole fell back into decline in April for the first time since mid 2020. Deteriorating supply chains notably contributed to renewed output falls for autos & parts and machinery & equipment manufacturing. Consumer goods manufacturers also suffered a stalling of production as household spending was diverted to services, reporting the weakest performance since June 2020, with companies often also reporting that higher prices were deterring customers.

In contrast, output of consumer-facing services industries rose worldwide at a rate which, excluding prior pandemic growth spurts as economies relaxed COVID-19 restrictions, was the strongest since data were first available in 2009. However, overall service sector growth slowed, led by the first drop in global real estate activity since May 2020, with banking services, transportation and healthcare services all also declining.

Selling prices meanwhile rose in all 26 sectors during April, with rates of inflation accelerating in all but six sectors. Some half of all sectors reported unprecedented rates of increase. A record rise in food prices is a particular concern, especially given that that the sector has also reported falling output continually now for three months, with the worsening trend linked to the Ukraine war.

Economic outlook: slower growth, higher inflation

Elisabeth Waelbroeck Rocha| Chief International Economist, S&P Global Market Intelligence

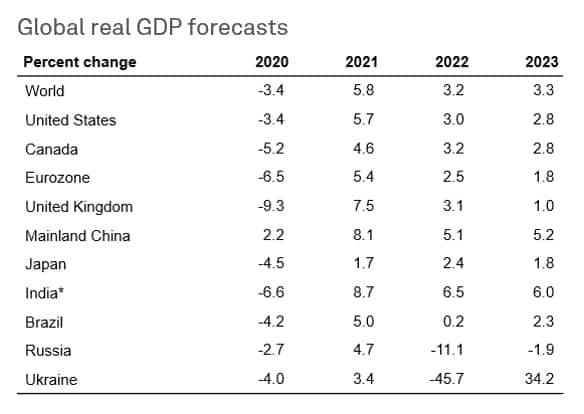

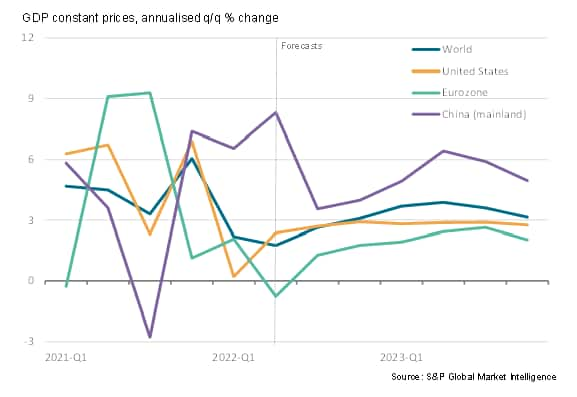

The latest PMI findings add to evidence that the economic outlook has darkened since Russia's invasion of Ukraine, and our global growth forecast has consequently been marked down. This in part reflects the substantial direct economic damage from the war but also reflects tighter financial conditions, the withdrawal of pandemic-related fiscal stimulus, and inflation's toll on consumer purchasing power and business. China's lockdown represents an additional headwind. After a 3.4% contraction in 2020 and a strong 5.8% rebound in 2021, world real GDP growth will likely slow to 3.2% in 2022.

As the latest PMI data suggest, the near-term outlook for inflation has meanwhile deteriorated. Led by surging energy and food prices, global consumer price inflation will likely pick up from 3.9% in 2021 to 6.6% in 2022, its highest pace since 1995. Commodity prices are expected to peak in mid-to-late 2022 and then retreat in response to rising interest rates, softening demand, and a gradual improvement in supply conditions.

Russia's war on Ukraine will have the biggest impact on Emerging Europe, which is set to fall into recession in 2022 as real GDP plunges 45.7% in Ukraine and 11.1% in Russia. Belarus, Kyrgyzstan, and Tajikistan will also experience contractions because of close economic ties with Russia. While other countries in the region will likely avoid recession, economic growth will weaken. While Ukraine's economic recovery is expected to take five years, Russia's recovery could take a full decade amid severe sanctions.

With inflation pressures building further due to the war, supply shortages intensifying and uncertainty rising, Western Europe's real GDP growth will likely slow sharply from 5.6% in 2021 to 2.6% in 2022 and 1.7% in 2023.

Further afield, the impact of the war will generally be less marked. With interest rates rising, the US economy faces a cooling-off period but no recession. US real GDP growth will likely slow from 5.7% in 2021 to 3.0% in 2022 and 2.8% in 2023.

The Asia Pacific region will sustain robust economic growth, benefiting from expanding international trade. After 6.1% real GDP growth in 2021, the region's economy will likely expand about 4.5% annually over the next three years, accounting for half of global economic growth.

In Sub-Saharan Africa, the steep rise in global food and fuel prices due to the Russia-Ukraine war have led several Sub-Saharan African authorities to introduce renewed or higher subsidies, temporary price controls, and suspension of selected import customs duties. These measures will raise public-sector debt levels.

In short, Russia's invasion of Ukraine and the surge in COVID-19 cases in mainland China are the latest in a series of economic shocks that have disrupted supply chains, fueled inflation, and slowed economic growth. Yet, as economies reopen, consumer spending and business investment are proving resilient. The task of subduing inflation while sustaining economic growth will depend on vigilant monetary and fiscal policies, improving supply conditions, and a bit of luck.

Read more in our special report on how Supply resilience is key to avoiding a global recession

Commodities: slower demand growth signals a potential cap on prices

John Mothersole| Director - Research, Pricing and Purchasing, S&P Global Market Intelligence

Continuing disruptions to supply chains, first from the pandemic with its series of variants, then two overlapping energy crises in China and Europe late last year, have kept markets off balance and commodity prices strong for the past year. The latest jolts come from the Russia-Ukraine war, which threatens Russia commodity exports, and widening COVID-19 lockdowns in mainland China, which has been the one reliable supply base for global manufacturing for the past two years.

The effect of these latest shocks has been another step increase in commodity prices, with the IHS Markit Materials Price Index (MPI), a broad collection of raw material prices, establishing a new record high in early March. The MPI had seemingly peaked back in May 2021. Indeed, between May and November of last year commodity prices, as measured by the MPI, declined by slightly more than 15%. This change in commodity markets was just beginning to push downstream in supply chains with intermediate goods price inflation globally beginning to slow.

Commodity prices, however, began rising once again in late November, jumping 24% between the end of January and early March alone as the crisis in Ukraine unfolded. The only good news is that prices have retreated slightly in the seven weeks since. Russian exports have for the most part continued to flow onto the global market, albeit with disruptions in Europe, the US and elsewhere because of buyer boycotts.

Measures of vendor performance - notably PMI gauges of backlogs of work, supplier delivery times and reported shortages - will worsen in the months ahead because of altered trade flows and some loss of supply, providing support to prices this summer.

However, another factor - softening demand - is entering the picture and may be enough to offset these supply-side effects and thus keep market balances from worsening. This is what commodity markets have been pointing to for the past month and a half.

Slower demand growth does signal at least a cap on commodity prices given the elevated levels they have risen to over the past two years. The absence of commodity price increases - and more likely - modest corrections, does mean one source of inflation will begin to abate over the next year, with a change be apparent in goods price inflation beginning in the second half of 2022.

Energy: loss of Russian oil offset but further disruptions cannot be ruled out

Jim Burkhard | Vice President, Energy

Waterborne deliveries of Russian crude oil have generally been on par with pre-invasion levels through early May, but this is likely to change as Russian production falls and Europe reduces Russian oil imports. Lower Russian output will be offset to a degree by the IEA oil release and weaker demand in China due to recent lockdowns. But the risk of a larger disruption from Russia cannot be ruled out. The era of a partitioned oil market has begun-along with a sharper divide between the interests of consumers and producers.

It should also be noted that new oil investment may face a less attractive market in the years ahead, given the desired shift to non-carbon energy. To account for higher risk and upstream inflation that is rising at its highest rate in years, the return required to justify investment is also higher. In our "break-even analysis" of various sources of oil supply, we have increased the cost of capital from 10% to 20%. This higher cost of capital is not, by itself, a guarantee that prices will stay high or move higher. But it is a force for upward pressure on oil prices over time.

Read more at Irreconcilable: The divide between oil consumers and producers-and what it means for the oil market, 15 April 2022

Maritime & Trade: supply chain recovery not expected until 2023

Jakub M. Kwiatkowski | Senior Economist, GTAS Forecasting

Due to aggression in Ukraine, the Russian Federation is facing tremendous multi-level international trade sanctions. Suspension of serving Russian markets by shipping companies, immediate exit from the market, or refusal to sell Russian products, together with customers' boycotts are being witnessed for the first time on a large scale.

In the short and medium term, Russian exports and imports are expected to significantly decrease. The duration and extent of the drop will not be lower than in the case of Crimea aggression in 2014, which amounted 40% drop in exports and decay of the shock taking five years. In the long term, the Russian economy can strengthen the links with mainland China, its largest trade partner. However, mainland China will not be able to absorb the whole sanctions-related trade shift.

Russia's aggression is therefore expected to contribute to a slowing in real value global trade growth to 1.7% from 11.3% in 2021. Similarly, volume growth will drop to 0.5% from 6.8%.

While all modes of transport grew significantly in 2021, growth will slow across the board in 2022. Seaborne trade volume grew by 4.5% in 2021 and the forecast for 2022 is an increase of 1.9%, according to the latest model. Overland trade noted significant growth of 13.6% in 2021, and for 2022 we predict a decline by 3.3%. Airborne trade will also note a decline in 2022 (by 1.7%), after impressive (15.3%) growth in 2021.

The cost of containerized transport has meanwhile climbed sharply compared with pre-COVID-19. In 2021, we have seen record high freight rates reaching its peak in September 2021-over $11,000 per 40-foot container (FEU)-according to the Freightos Baltic Global Container Index.

The rise in container transport costs was partially related to rising fuel prices, but also the global shortage of containers, continuing significant congestion in many seaports, particularly in mainland China and the United States; extended restrictions in many parts of the world because of COVID-19; and growing global demand in the pandemic recovery. In 2022, freight rates on most trade lanes will continue to increase due to the replacement demand for Russia-Ukraine cargo, with backhaul freight rates remaining the strongest routes.

We do not see any significant relief to the congested supply chains out of Asia in the short term, as the demand will still be high in the first half of 2022, slowing gradually in the second half of the year. In North America, we are also not expecting any notable change by the end of this year, so most probably we would see the supply chain recovery taking place no sooner than in 2023.

Read more in our report: War, sanctions, and resilience: Implications for Russian international trade

Agriculture: less than 70% of the potential area for spring crops will be planted in Ukraine this year

Lee Bridgett | Food and Agricultural Commodities

A major question related to how the war has impacted Ukraine's spring planting season. While there have been reports of input shortages such as seed and diesel fuel, spring planting has firmly gotten underway. Approximately 2 million hectares of crops have been sown so far, approximately the same level as last year at this time, according to Ukrainian Deputy Minister of Agrarian Policy and Food Taras Vysotsky. However, Deputy Minister Vysotsky has also separately stated that less than 70% of the potential area for spring crops will be planted this year, in part due to landmines in the Chernihiv and Sumy oblasts. Vysotsky has reiterated that the country has sufficient production for domestic needs despite reduced plantings, and that the country is still expected to have some level of a production surplus for export.

Limited grain exports have meanwhile resumed to Europe via rail since the conflict started, but without measures to increase capacity this is reportedly only capable of shipping 10-15% of Ukraine's normal export volume. There is an ongoing effort to reopen supply lines from Ukraine, but how much export volume can be restored remains to be seen. The EU has announced the establishment of "green corridors" with Ukraine. These will be fast-tracked trading routes allowing Ukraine to export goods through Poland and via the Baltic Sea, rather than through currently blocked Black Sea ports. Ukraine's Agriculture Ministry is also reportedly in talks with the Romanian government about exporting agricultural products through the Romanian port of Constanta.

Read more at Russian invasion of Ukraine: Two months of war intensifies challenges for global food and agriculture, 28 April 2022

Automotive: Global Auto Production Forecast Downgraded Further for 2022

Mark Fulthorpe| Executive Director, Global Light Vehicle Production Forecast, plus other Autointelligence experts

The deteriorating picture for the automotive market captured by the latest PMI data supports our downward revision to our global light-vehicle production forecast for 2022 and 2023, by about 2.6 million units for each year. Following our March forecast round, we now expect global light-vehicle production at 81.4 million units in 2022 and 88.5 million units in 2023.

Since the invasion of Ukraine we have significantly reduced the outlook for vehicle production. In the March forecast release, we removed 2.6 million units from our 2022 and 2023 outlook, but the downside risk is enormous and further cuts were made in April. In March we cut 1.7 million units from European production alone, which broadly includes just less than 1 million units from lost demand in Russia and Ukraine. The reasons for the remainder of the cut are worsening semiconductor supply issues and a loss of Ukraine-sourced wiring harnesses and other components, both of which will affect production in other markets. April saw a further reduction in the outlook, to 80.6 million units and 87.8 million units respectively as the effects of lockdown in mainland China, particularly in Shanghai, compounded the worsening situation.

Broader, extended lockdowns in mainland China and the complete loss of Russian palladium supply are the greatest potential risks to the industry. In total, over 30 million units have been removed from our light-vehicle production forecast between now and 2030.

Palladium: Next potential challenge

Although of low probability currently, palladium has the potential to become the industry's biggest supply constraint. Russia produces 40% of the world's mined palladium, according to the United States Geological Survey. Around two-thirds of palladium use is in vehicles, where it is the active element in catalytic converters for exhaust after-treatment. If Russian palladium supplies were suddenly interrupted (due to a Western boycott, or Russia stopping supplies), production of all vehicles using such sourced material (including hybrids) could potentially stop.

Read more in our reports:

Global Auto Production Forecast Downgraded Further for 2022

Russia, Ukraine and the impact on the automotive industry, 28 March 2022

Conflict outlook: Putin's objectives in doubt

Alex Kocharov | Principal Analyst, Country Risk

On 18 April Russia reportedly began the so-called 'Phase 2' of its 'special military operation' in Ukraine, the Kremlin's stated objective of which is to capture all of the Donbas region. If successful, it would enable Russian President Vladimir Putin to claim 'victory' and call for a ceasefire. On 30 April, Russia's Foreign Minister Sergei Lavrov said that the Russian government was 'not setting any specific dates for its military forces in Ukraine', which indicates the government's acceptance that fighting will be protracted,

and that it is managing the Russian public's expectations prior to Putin's address at the 9 May Victory Day celebrations.

The Russian ground forces' ability to achieve this objective within Putin's likely preferred timeline is in doubt, given their performance to date and their substantial losses, and likely combat fatigue, among most of the forces involved.

A claim by a senior Russian officer, Major General Rustam Minnekayev, made on 22 April, that Russia's objective is to take control of all of Ukraine's Black Sea coast to the borders of Moldova and Romania, and unexplained security incidents on 25-26 April in breakaway Transdniestria, a pro-Russian entity in Moldova, were probably elements of a deception plan aimed at keeping Ukrainian forces tied down covering the Odesa direction. An operation of this scale, concurrent with the Donbas offensive, would be beyond the capacity of Russian ground forces currently deployed in Ukraine.

Read more about Russia's invasion of Ukraine, 5 May 2022

Discover the latest analysis, forecast, and insight on the macroeconomic impact of the Russia-Ukraine war.

© 2022, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.