US-China trade dispute – implications for the global natural gas liquids market

The US-China trade dispute is complicating economic and political relations. The tariff coverage and levels continue evolving and are still subject to negotiations and uncertainties.

As announced in April 2018, IHS Markit expected that the global liquefied petroleum gas (LPG) market to be efficient and fluid enough to ease the situation. LPG has become a true fungible commodity, with about one-third of global production (95 million metric tons in 2018) being traded in dedicated tankers. Plus, so many traders in the marketplace can optimize cargo movements. The market has evolved largely as we expected.

US-to-China direct LPG exports began dwindling right after the tariff announcement. By August, when the tariff was implemented, the US-to-China LPG shipments were reduced to zero. At the same time, the rest of Northeast Asia (including South Korea, Japan, and Taiwan) picked up additional US volumes. Indonesia, not a regular importer of US LPG, began taking in an average of three very large gas carrier (VLGC) cargoes per month.

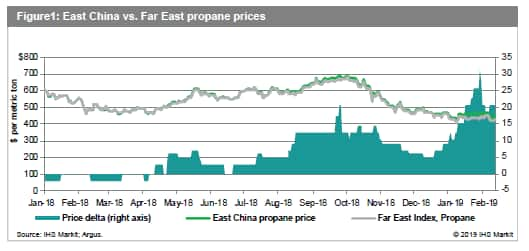

The trade pattern shift wasn't without a cost, however. Chinese LPG import prices were historically at parity with the broader Far East Index. Often, imports could be purchased at a $2 to $3 per ton discount, reflecting the shorter transportation distance from Middle East to China, especially South China. However, since April 2018, Chinese LPG prices have developed a cargo swap premium over the Far East Index (see Figure 1).

The East China premium rose as high as about $30/ton in late January, but it is still much lower than a full 25% tariff would imply. The premium itself varies, reflecting changing market sentiment. When Chinese demand is high or the overall market is tight, a bidding process typically increases the price premium. Winter residential and commercial demand also has supported an elevated premium this year.

The US is the most important market for driving global LPG incremental supply. With its market size, demand variety, and growth potential, China is the most important market for driving demand growth. The US and Chinese LPG markets not only offset each other in volumetric growth, but also largely mirror each other in LPG composition. US LPG is rich in propane, resulting in much higher propane content in exports. Chinese demand is mostly driven by propane-oriented chemical uses, including propane cracking and propane dehydrogenation (PDH) development. With these characteristics, tariff development is critical, as it will continue to affect global LPG trade flow and prices.

What should we expect in the global LPG market if the

tariff remains?

US natural gas liquids (NGL) production is driven by strong gas

production growth, mainly from the Permian Basin associated gas and

in the Appalachia region non-associated gas. In the next few years,

we expect continued US gas production growth as additional

infrastructure alleviates take-away constraints. As a result, US

LPG production and exports are also expected to increase. At the

same time, after relatively muted demand growth in 2018, China is

expecting another wave of PDH development. IHS Markit anticipates

another 12 PDH projects will be added in China over the next five

years, with a total propylene capacity of 5.3 million tons per

year, implying an additional 6.5 million tons of propane

demand.

So far, a head-to-head tariff conflict has been avoided via cargo swaps and trade rearrangements within Asia. As China's LPG demand and US export grow, China will continue to rely on swappable markets to avoid a direct tariff impact. Our question: Is there a point when the market runs out swap volumes in Asia? If so, what happens next?

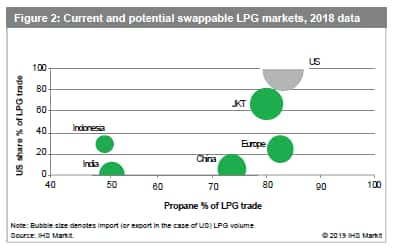

Figure 2 compares several current and potential swappable markets. We included markets with significant size that are currently importing US LPG or might do so. The key metrics to consider are import characteristics, including volume, sources, and propane versus butane composition. Proximity to the Chinese market plays an important role, as long-dis-tance volume swaps increase freight cost.

The first, most natural swappable market is Northeast Asia - specifically Korea, Japan, and Taiwan (JKT) - due to its proximity to China. In 2018, JKT imported 19.2 million tons of LPG, including 68% from the US, a 10% increase over 2017. In 2017, about one-quarter of China's LPG imports were from the US. That percentage dropped to just 6% in 2018 and stands at zero since August 2018. As Northeast Asia is near capacity for additional swappable volumes, additional Asian markets will likely be involved. For example, Indonesia imported about 5.5 million tons of LPG in 2018, including about 30% from the US, compared with only 12% in 2017.

As Asia runs out of swappable volumes, the next potential markets could include India or Europe. Both markets offer the depth - and thus flexibility - for trade rearrangements. India is currently importing about 12 million tons of LPG each year. Even though it has not imported any LPG from the US due to its close proximity to the Middle East, India has been increasing propane share in its overall LPG imports, presenting itself as a strong candidate for propane cargo swaps. In 2018, propane accounted for about 50% of total LPG imports. In Europe, imports are traditionally propane-biased, and currently a quarter of these imports are from the US. If these markets are called upon to participate in the cargo swaps to avoid tariffs, however, logistics costs would rise, escalating swap premiums.

However, not all potentially swappable volumes will be exchanged. For example, the existing contract structure will constrain the flexibility of cargo movements. Additionally, import structure - such as a propane versus butane split - can also complicate cargo rearrangement. A VLGC typically carries four LPG tanks, which each store either propane or butane. An all-propane VLGC cargo can be relatively easily swapped with another all-propane cargo, but it would take multiple mixed VLGCs to accomplish the same goal. VLGCs might need to make multiple port stops, further increasing logistics challenges and swap premiums. And if Chinese importers continue to pay higher premiums, certain demand will likely be reduced, potentially weakening global LPG prices.

What will be the impact on ethane?

Ethane is not yet on the tariff list, and there is no current

ethane trade between US and China. Ethane would experience a more

direct impact from tariffs because it is single-sourced from the US

and there is no alternative market to help work around the tariff

issue. This is one of the major concerns of Chinese companies that

are interested in importing US ethane.

***

United States Natural Gas Liquids Markets Weekly Report

• Assess US NGL markets short-term outlook to inform trading

decisions

• Understand US NGL markets medium to long-term outlooks and trends

for big picture

• Evaluate market factors such as supply sources, end uses &

waterborne freight

• Use current U.S. weather trends to anticipate and plan for

potential risks

• Fill gaps in historical lagging EIA data with credible current

projections

Download free sample: ihsmarkit.com/NGL-Weekly-Sample