Pharmaceutical industry groups raised major alarm bells after US President Donald Trump signed the “Most Favored Nation” executive order (EO) on 13 September, which aims to introduce revolutionary new drug price controls into the US market through international reference pricing (IRP). And with reason – according to IHS Markit research, pharmaceutical prices could be dramatically affected. We have reviewed prices for 20 leading products and compared them with countries that could be part of the new price comparison. All countries included in our assessment had prices that were 70-80% lower than the US price on average. The US consistently had the highest prices for all 20 drugs among the eight countries, although the international country-to-US price differential ranged from of -29% to -98%.

The HHS, and the Centers for Medicare and Medicaid Services (CMS) have not yet disclosed any additional details regarding these proposed reforms, but the executive order charges the HHS with testing a new payment model for which Medicare would pay no more than the most-favored-nation price for “certain high-cost” physician-administered Part B drugs as well as Part D pharmacy drugs with “insufficient competition”. According to the administration, the most-favored-nation price would be calculated as the lowest price for that prescription drug or biologic sold in another Organization for Economic Co-operation and Development (OECD) country with a “comparable” per capita GDP to the US. The IRP model goes even further than previously proposed policies that have focused only on Medicare Part B drugs but broadening the applicability to also include Part D pharmacy drugs. According to the Centers for Medicare and Medicaid Services (CMS), Medicare spending on Part B drugs amounted to nearly 10% of the overall prescription drug spending in the US, meanwhile spending on Part D drugs reached USD168 billion in 2018, and represents around 50% of the total US prescription drug market (USD335.0 billion).

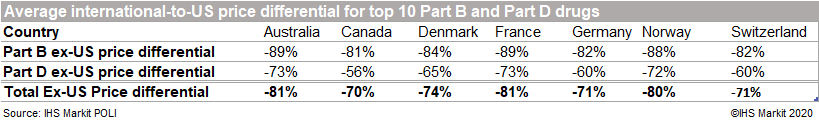

For the IHS Markit study, we assumed that countries with the closest per capita GDP to the US would be used. According to the latest OECD data, several European countries as well as Australia and Canada could be included in that basket. We narrowed this list down to seven countries – Australia, Canada, Denmark, France, Germany, Norway, Switzerland.

Next, we narrowed down our list of products to the top ten highest selling drugs reimbursed under Part B and Part D in 2018 (source: CMS, latest available), and compared the current wholesale acquisition cost (WAC) prices for these drugs in the US with prices in the seven countries using IHS Markit’s proprietary pricing database POLI. To ensure pricing comparisons were consistent across all markets, we calculated the manufacturer price per unit of strength and unit of form in US dollars.

Results

On average across the 20 products, all countries included in our assessment had manufacturer prices that were 70-80% lower than the US price. The US consistently had the highest prices for all 20 drugs among the eight countries, although the international country-to-US price differential ranged from a low of -29.0% for Keytruda (pembrolizumab; Merck & Co, US) in Canada to -97.7% for Lyrica (pregabalin; Pfizer, US) in Australia. The countries with the lowest prices on average relative to the US were Australia, France, and Norway, despite the latter having a higher per capita GDP than the US in 2018 (OECD; latest available).

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData

It is critical to note that this data does not take into account manufacturer discounts and rebates, with the expectation that if net prices were used, the price differential would likely be mitigated. Although data on rebates is limited, the CMS estimated that rebates represented 17.8% of the total spending on Part D drugs in 2014. Furthermore, generic entrants likely play a major role in pricing for many of these branded products, and particularly so in regulated markets. Although our analysis excluded pricing from generic products, price erosion for the originator drug following generic entry is usually more pronounced in regulated markets than it would be in the US.

US IRP payment model vs Global IRP models

There are several interesting components of the proposed US IRP model. Compared to IRP models globally, the US model could incorporate a large subset of OECD countries in its reference basket, putting it at odds with other developed countries which typically reference between 1-5 (France and Australia) or 5-10 (Canada, Denmark, Norway, Switzerland) markets (source: IRP Guidebook).

Moreover, use of the “lowest price” in the most-favored-nation IRP model puts the US at odds with other high-income developed countries that largely rely on the “average price” within their basket as a benchmark, underscoring the significance of the most-favored-nation language.

One of the major question marks during any discussion of US IRP application is which reference countries will have available prices at time of launch in the US itself, given typical launch sequencing patterns. Ex-US markets often deal with this conundrum by setting provisional launch prices or undertaking frequent re-referencing (a parallel can also be drawn with Germany, which sees 12 months of free pricing but then negotiates oftentimes steep discounts for its reimbursement rates). Notably, as part of the previously proposed International Pricing Index (IPI) model, CMS was considering applying price controls to newly approved and marketed drugs without any international sales; this provision could be resurrected under the new model.

It is also deemed likely that US policymakers will control for differences between the US and reference markets in product parameters such as pack size, strength and formulation, another common IRP practice internationally.

Global impact of most-favored-nation payment model

The IRP model proposed in the most-favored-nation EO could introduce the largest pricing and reimbursement (P&R) reforms in the country’s history. With price cuts of up to 80% on average for top-selling drugs, the policy could significantly lower US pharmaceutical spending even if it targets a small number of Medicare drugs. The implementation of a P&R payment model of this nature, even in pilot format, would still surpass any other proposed models and reforms in the US, and would likely have repercussions globally.

The Pharmaceutical Research and Manufacturers of America (PhRMA) industry group’s president and chief executive (CEO) Stephen Ubl argued that the “irresponsible and unworkable policy” would give foreign governments influence in how senior citizens in the US access treatments, adding that the expansion of the policy to include Part D drugs is an “overreach that further threatens America’s innovation leadership and puts access to medicines for tens of millions of seniors at risk”. Separately, Michelle McMurry-Heath, president and CEO of the Biotechnology Innovation Organization (BIO) industry group, also issued a statement in which she expressed concern that the Trump administration’s “reckless scheme” would cause inevitable delays to innovation, significantly reducing investment in research and development. BIO has confirmed that it will leverage every tool as its disposal – including potentially litigation – to resist the EO.

The price cuts could also adversely affect pharmacy benefit managers (PBMs), pharmacies, and insurance companies as manufacturers slash rebates and discounts provided to other supply chain stakeholders potentially necessitating premium increases. Furthermore, ex-US countries included in the basket could also be directly affected as manufacturers try to mitigate the impact of the policy by delaying launches of new drugs in those markets.

Legal challenges loom large, but risk remains high

The IRP model in its present form faces a number of hurdles to full-scale adoption. In addition to the model almost certainly seeing litigation brought forward by industry groups to challenge its constitutionality, it will require congressional approval to become a permanent policy lever, beyond the initial pilot project. Nevertheless, the US pharmaceutical industry is facing major uncertainties ahead as it battles one of the biggest – if not the biggest – threat to the sector. The impending US elections are unlikely to bring reprieve, because regardless of whether President Trump is re-elected, or Democratic Presidential candidate Joe Biden wins the presidency, P&R reforms, and particularly IRP policies that have long been supported by Democratic lawmakers, are now increasingly likely to be implemented in the US.

Related Company Profiles

IHS Markit Ltd

Trump

Phrma

Biotechnology Innovation Organization

Pharmaceutical Research and Manufacturers of America