UK flash PMI signals economic resilience amid Omicron wave

A resilient rate of economic growth in the UK during January masks wide variations across different sectors. Consumer-facing businesses have been hit hard by Omicron and manufactures have reported a further worrying weakening of order book growth, but other business sectors have remained encouragingly robust.

Looking ahead, while the Omicron wave meant the hospitality sector has sunk into a third steep downturn, these restrictions are now easing, meaning this downturn should be brief. Many business and financial services companies have meanwhile been far less affected by Omicron, and saw business growth accelerate at the start of the year.

Business confidence in the outlook also picked up, driving sustained solid jobs growth. With inflationary pressures remaining elevated at near-record levels, this all adds to the likelihood of the Bank of England hiking interest rates again at its upcoming meeting.

Omicron hits the service sector

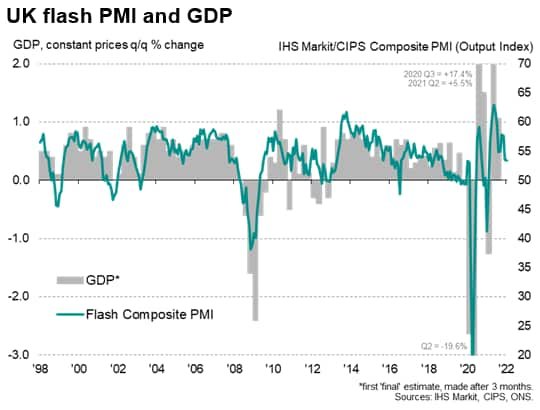

UK economic growth slowed slightly in January as a strengthening expansion of business services activity helped offset a steep downturn in activity in consumer-facing sectors amid the Omicron wave.

The IHS Markit/CIPS composite PMI output index, covering both services and manufacturing, fell from 53.6 in December to 53.4 in January, according to the early 'flash' reading, indicating the slowest rate of expansion since the lockdowns in February of last year.

Dual-speed service sector

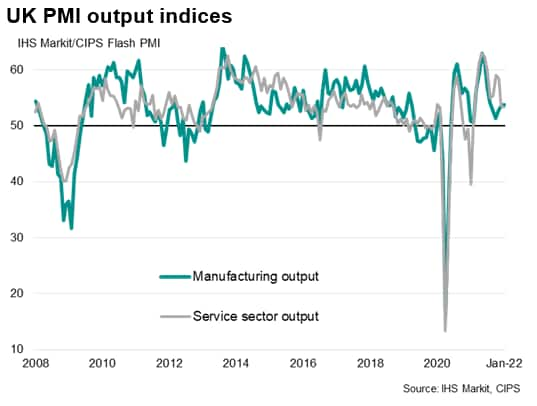

Service sector growth slowed - albeit only slightly - in January, easing for a third month running to hit the weakest since last February. There were, however, wide divergences within this vast section of the UK economy.

On one hand, rising COVID-19 cases and heightened restrictions imposed to contain the Omicron variant caused activity in the hotels & restaurant sector to fall sharply for a second month running, dropping at a rate not seen since last February, accompanied by a further sharp deterioration in transport and travel services activity.

On the other hand, growth of business-to-business services accelerated to the fastest since last July, with financial services activity also picking up strongly during the month, helping to largely offset the weakness in hospitality-oriented sectors.

Factories buoyed by easing supply constraints

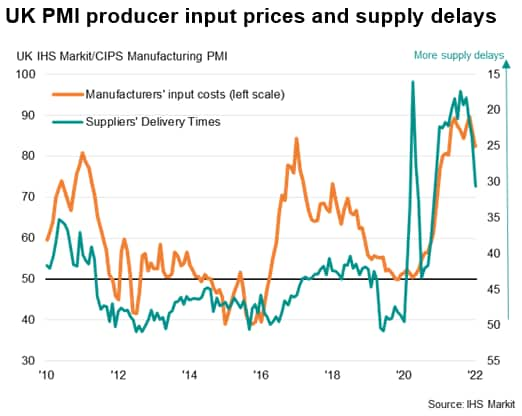

Manufacturing output growth meanwhile ticked up to the fastest since August as alleviating supply constraints allowed factories to stem the recent rapid growth of backlogs of uncompleted orders. Suppliers' delivery times lengthened to the least extent since November 2020.

A further effect of the easing supply crunch was that fewer supplier price hikes were reported, helping reduce the overall rate of manufacturing input price inflation to the slowest since last April.

Slower goods price growth offset by surging service sector charges

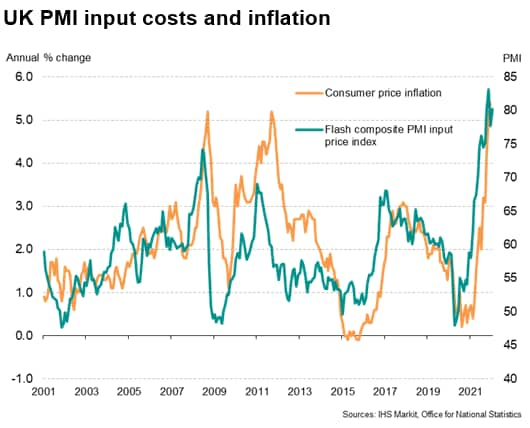

Although manufacturing input cost inflation slowed, feeding through to a marked cooling of factory gate selling price inflation, service sector costs rose at an increased rate, fueled in particular by higher energy prices and wage growth. Charges levied for services consequently rose at the second-steepest rate on record as firms passed higher costs on to customers.

Measured across both manufacturing and services, input cost and selling price inflation re-accelerated in January as a result, pointing to sustained elevated consumer price inflation in coming months.

Resurgent demand

While the Omicron wave meant the hospitality sector has sunk into a third steep downturn in December and January, case numbers appear to have peaked and these restrictions are being lifted, meaning this downturn should be brief. In fact the survey is already seeing some signs of resurgent demand for many travel-related services. Many business-facing and financial services companies have meanwhile been far less affected by Omicron than in prior COVID-19 waves, and saw business growth accelerate at the start of the year in response to signs that the Omicron wave appears less disruptive than feared, albeit with activity being constrained in many cases by staff absenteeism due to illness and self-isolation, as well as difficulties finding suitable recruits to fill vacancies. Note that demand - as measured by new business - rose across the UK services economy to a greater extent than output to a degree not seen for a year, reflecting these labour market and ongoing supply chain constraints.

Diverging outlooks

Service sector prospects consequently improved in January, with new orders growth lifting from December's ten-month low and expectations for the year ahead perking up to the brightest since August

The outlook is less bright in manufacturing, however. While output growth was boosted by fewer supply constraints, growth of new orders slowed sharply to the weakest since January of last year, registering the second-worst performance since June 2020. New export orders for goods barely rose after four months of continual decline, with around one-in-three firms linking lost export business at least in part to Brexit. In manufacturing, output growth exceeded that of new orders in January, hinting at excess capacity developing. At the same time, manufacturers' expectations of output growth in the coming year sank to a one-year low.

Chris Williamson, Chief Business Economist, IHS Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

© 2022, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.