UK economy edges back into growth in December as lockdown measures ease

- Flash UK composite PMI rises from 49.0 to 50.7

- Service sector business activity stabilises as COVID-19 lockdown measures ease, manufacturers enjoy temporary boost from pre-Brexit stockpiling

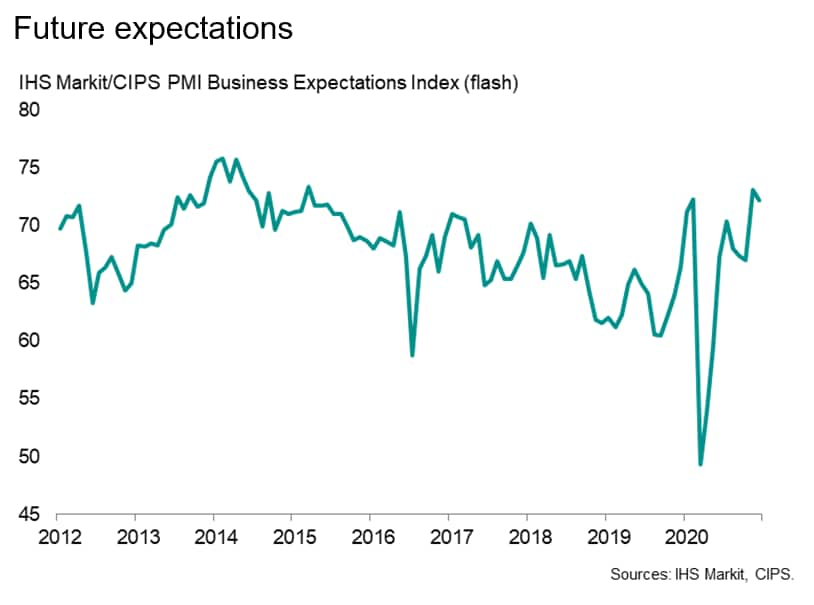

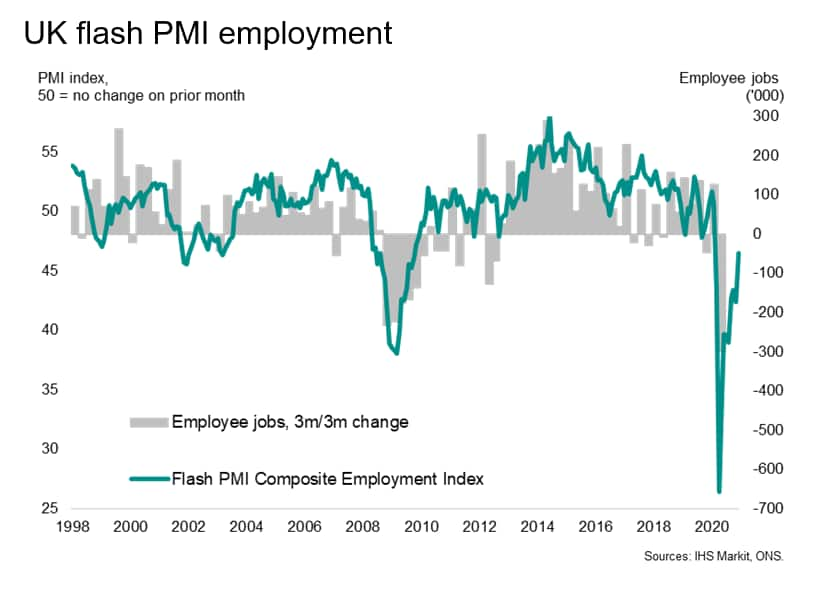

- Vaccine roll-out buoys optimism, eases job losses

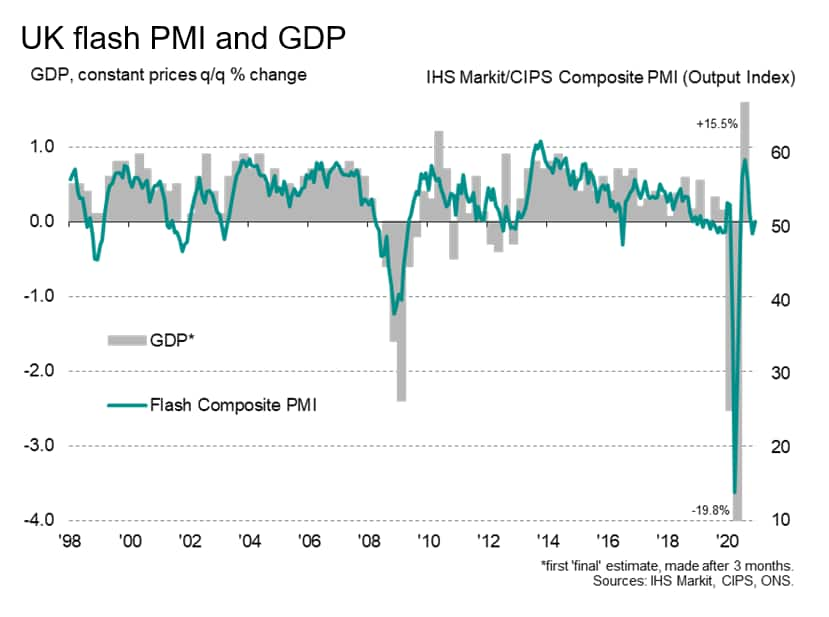

The UK economy returned to growth in December after the lockdown-driven downturn seen in November, according to preliminary PMI data covering manufacturing and services, adding to signs that the hit to the economy from the second wave of COVID-19 infections has so far been far less harsh than the first wave in the spring.

PMI back in expansion territory

At 50.7 in December, the seasonally adjusted IHS Markit/CIPS Flash UK Composite PMI - based on approximately 85% of usual monthly replies - was up from 49.0 in November and back above the crucial 50.0 no-change mark to indicate a very modest renewed expansion.

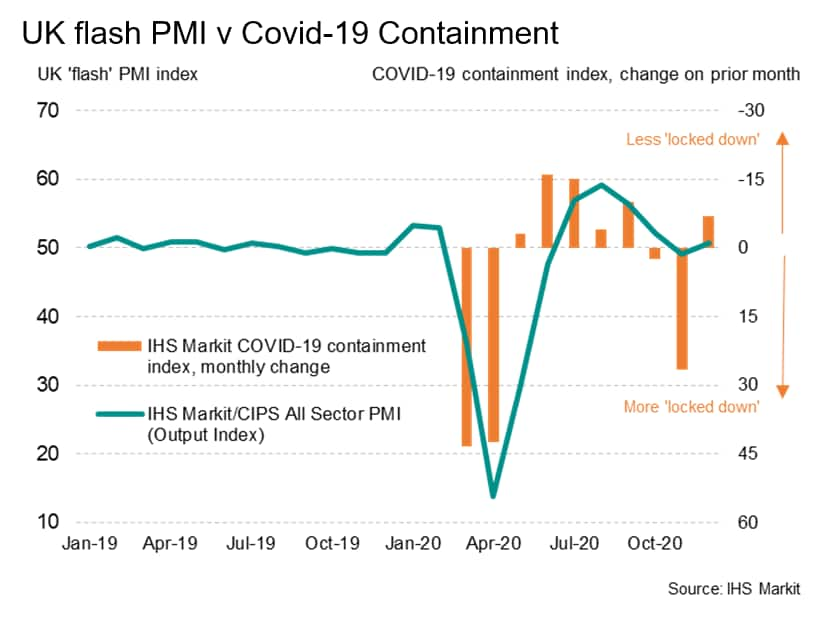

The improvement in the PMI coincided with an easing of some COVID-19 containment measures compared to November, which had seen a national lockdown. In December, a new tiered system of containment measures was introduced to better target local outbreaks, which collectively represented a modest easing of national restrictions.

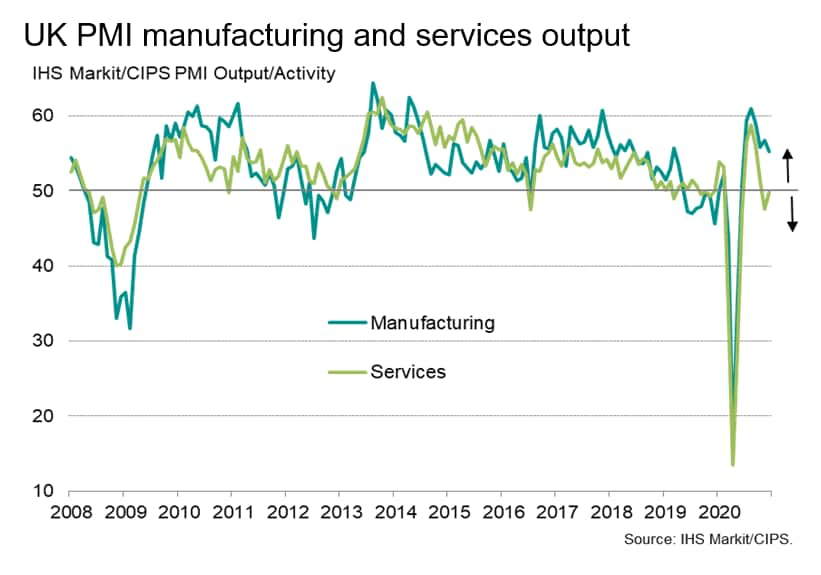

The recovery lacked vigour, however, as the service sector remained under particular strain, contracting marginally again as ongoing social distancing measures due to the new tiered lockdowns continued to hit many parts of the economy. Services activity has now fallen for two months as the new lockdowns have hit, following four months of expansion. Consumer-facing services, notably hotels, restaurants and tourism, reported further marked declines in output during December, largely offsetting renewed growth in business services, transportation and manufacturing.

Manufacturing output rose for a seventh successive month, albeit with the rate of increase slipping to the lowest since June.

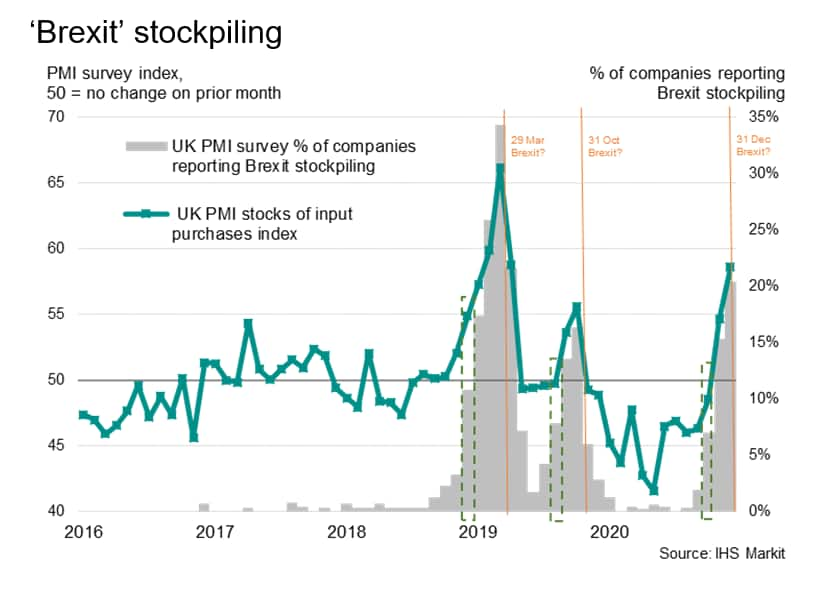

The manufacturing and transport sector improvements were linked to reviving global trade and a short-term boost from Brexit-related stockpiling, which reportedly buoyed order books and exports during the month. Around 20% of manufacturers, for example, reported that activity had increased during the month due to Brexit and related stockpiling.

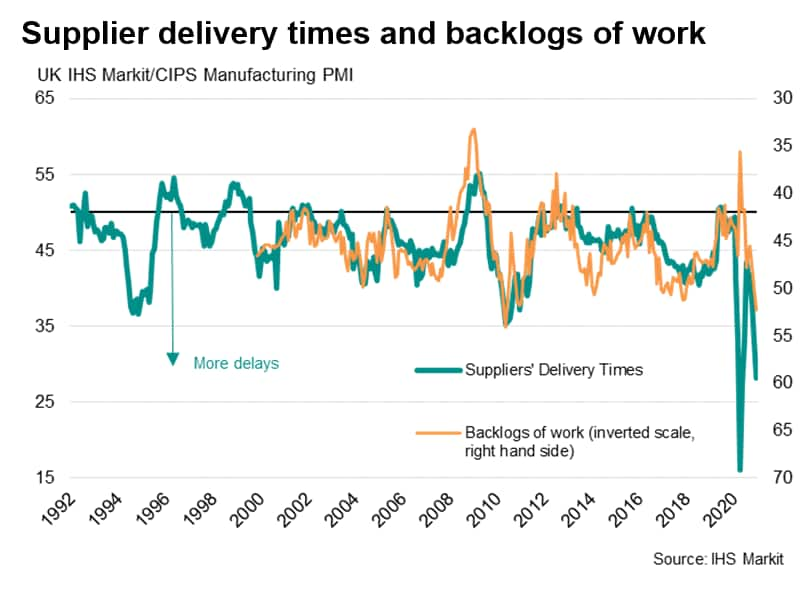

UK supply chain delays among highest ever recorded

On the other hand, Brexit stockpiling appears to have exacerbated existing global supply chain delays, constraining output at some manufacturing firms. Around 45% of the survey panel reported longer wait times from suppliers, while only 2% saw an improvement. The resulting lengthening of lead times in December was the third-steepest since the survey began in 1992, exceeded only by those seen amid COVID-19 shutdowns in April and May.

Shortages of critical inputs, alongside pressure on capacity following forward-purchasing by clients ahead of Brexit, meanwhile contributed to the sharpest rise in backlogs of work across the manufacturing sector since May 2010.

Job losses moderate

While job losses continued to be reported during the month, it was encouraging to see the rate of job cutting ease to the lowest since the start of the pandemic. Business optimism about the year ahead also remained buoyant, reflecting the light at the end of the tunnel created by the roll-out of the COVID-19 vaccines. Optimism waned slightly compared to November, however, largely due to rising concerns over a no-deal Brexit.

Chris Williamson, Chief Business Economist, IHS Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

© 2020, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.