Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer LoginsHyundai Motor Rises to #3 in US Market

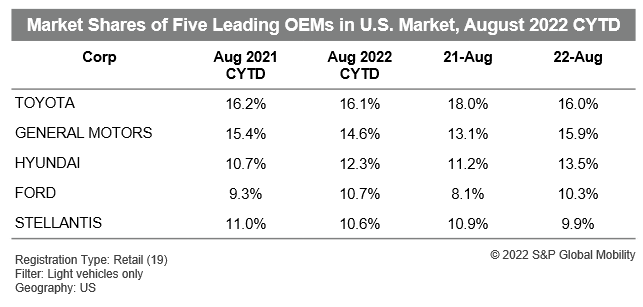

Hyundai Motor Group recently has emerged as one of the top-performing new vehicle manufacturers in the US. New-vehicle registration data from S&P Global Mobility through the first eight months of this year (see table below) indicate Hyundai Motor now ranks as the No. 3 OEM in the US, based on retail corporate market share. The combined Hyundai, Kia, and Genesis brands now surpass perennial powerhouses Ford Motor Company, Stellantis Corp., and American Honda Motor Co., Inc.

Hyundai Motor's performance has been driven by (at least) three strengths, including the freshness and timeliness of its three U.S. product portfolios, the robust brand loyalties of Kia and Hyundai owners, and high manufacturer loyalty across all three brands.

Product Portfolios

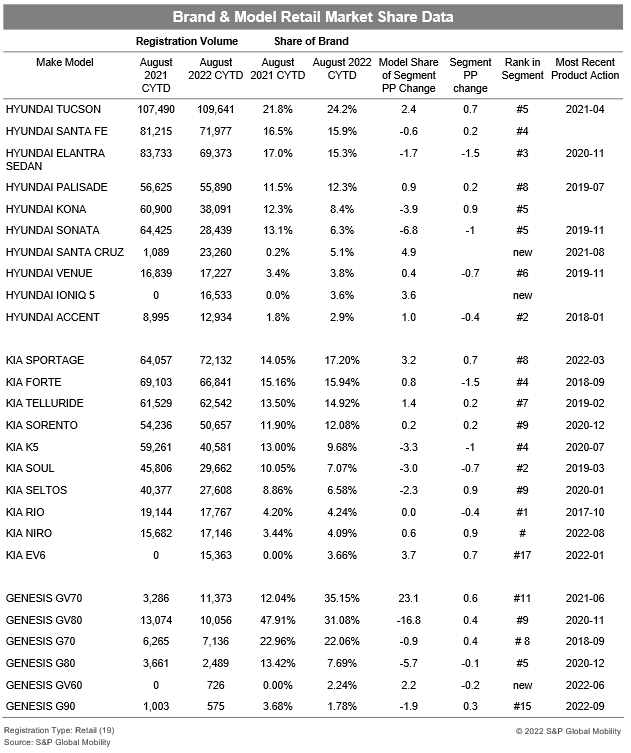

As illustrated in the table below, every Hyundai-branded in-market model except the discontinued Accent has been either launched or re-designed since mid-2019. Similarly, every Kia model except Rio and Forte has been introduced or re-designed since early 2019. Genesis's portfolio is equally fresh, with just the G70 languishing in its present form since the end of 2018. (As cars, Accent, Rio, Forte, and G70 compete in a much smaller - and declining - part of the market when compared to crossovers.)

Just as important as the freshness of Hyundai Motor's product offerings, though, is the relevance of its products. Both the Hyundai and Kia brands offer entries in every one of the core CUV segments, from three-row midsize utility down to sub-compact utility (neither Hyundai nor Kia participates in the full size utility segment, but this category accounts for just 2.3% of the retail market August 2022 CYTD). Lastly, the three-row Palisade and Telluride crossovers, introduced in the 2020 model year, for the first time offer serious competition in one of the largest segments, and both products have already received freshenings in 2022.

Genesis, launched in August 2016, still lags major luxury brands in the breadth of its portfolio, and initially was hampered by an all-car lineup, but it now offers three crossovers in the heart of the luxury market.

Lastly, Hyundai Motor has demonstrated its competitiveness by its speedy entry into the US EV market. With the Hyundai Ioniq 5 launch last December and the Kia EV6 arrival two months later, the corporation now offers two competitive EVs, more than several of its larger competitors. Furthermore, the Ioniq 5 and EV6 now rank #6 and #7, respectively, among all EVs (based on August 2022 CYTD retail registrations); if the four Teslas are removed, the Hyundai Motor Group products rank second and third, trailing only the Mustang Mach-E.

Brand Loyalty

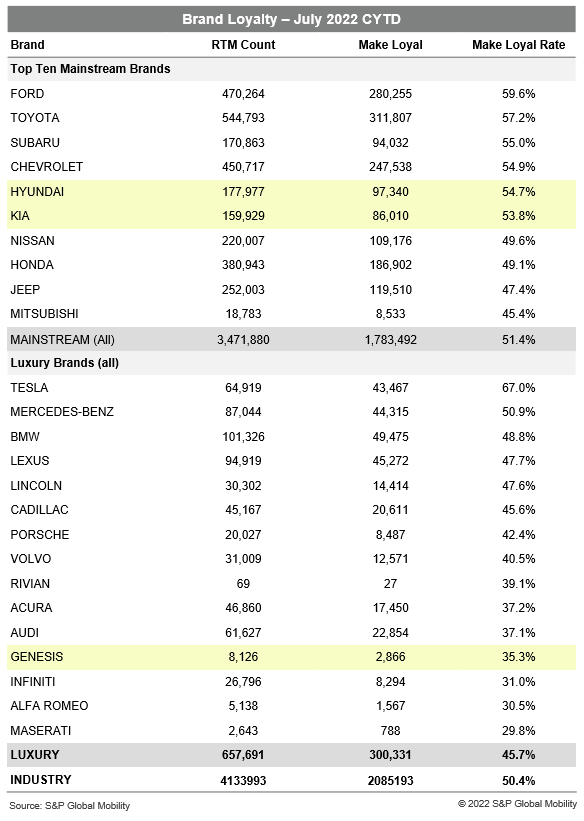

Hyundai Motor's impressive retail share partly comes from both Hyundai's and Kia's ability to retain existing owners. As shown below, these two brands currently rank No. 5 and No. 6 among the 19 mainstream brands in brand loyalty. Hyundai Motor is the only manufacturer to place two brands in the top 10 on this metric.

Both brands have retained such high percentages of their owners despite not offering any full-size pickups, midsize pickups, or, until recently, any compact pickups (these three pickup segments account for 17% of the retail industry (August 2022 CYTD).

Genesis' brand loyalty has not been as substantial as that of its stablemates, but part of that is due to the brand's newness to market. With seven-month brand loyalty of 35.3%, Genesis ranks No. 12 among the fifteen luxury brands for which we have sufficient data. Until recently Genesis loyalty was curtailed by a lack of crossovers, but the recent additions of the GV60, GV70, and GV80 should improve Genesis owners' likelihood of acquiring another one.

Manufacturer Loyalty

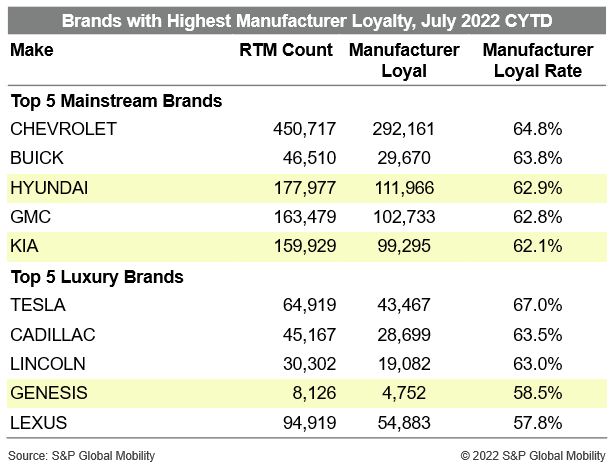

S&P Global Mobility registration data indicate that all three Hyundai Motor brands have one metric working in their favor: even when owners defect from any of these brands, they have a strong propensity to stay within the Group. As illustrated below, the Hyundai and Kia brands rank #3 and #5, respectively, among all 19 mainstream brands based on their likelihood to remain loyal to the corporation - surpassed only by three GM brands. And, Genesis ranks No. 4 in the luxury space on this metric, trailing only Tesla, Cadillac and Lincoln.

While the three Hyundai Group brands have made enormous progress, it is noteworthy that the Group still lacks that "stand-out" category leader that becomes a household name, a la Camry, Accord, F Series. Nevertheless, the Group has grown from a second- or third-tier player ten years ago into a top OEM based on several key metrics, a feat deserving a lot of praise in an industry with over 20 OEMs, 40 brands and three hundred models.

Feature your exclusive automotive industry insights on our Mobility News and Assets Community page, a platform that is designated for automotive and mobility industry thought leaders and the community.

-----------------------------------------------------------------------------------------

This automotive insight is part of our monthly Top

10 Trends Industry Report.The Report findings are

taken from new and used registration and loyalty data.

The September report is now available, incorporating July 2022

CFI and LAT data. To download the report, please click below.

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.