Global manufacturing PMI highlights sustained supply constraints and price pressures

- Global supply chain woes persist in May

- Asia manufacturing performance on the line amid supply constraints

- Sustained supply and demand gap could lead to price stickiness

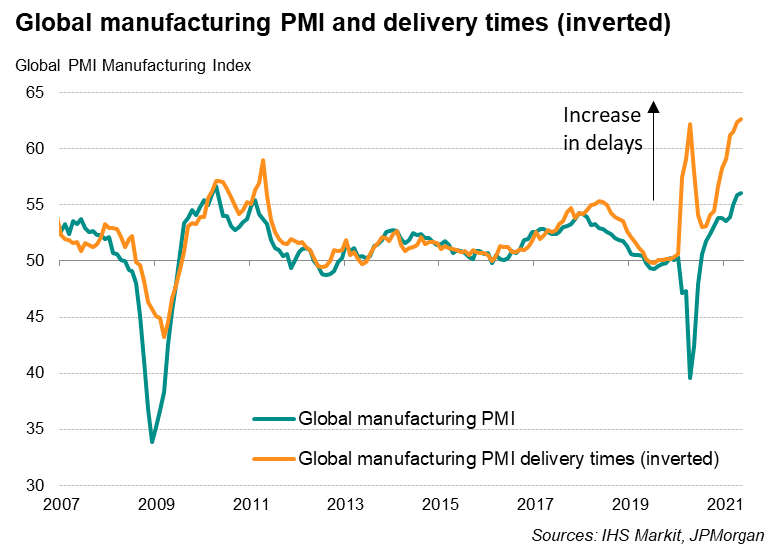

The JPMorgan Global Manufacturing PMI, compiled by IHS Markit from its proprietary business surveys, suggested that the goods-producing sector extended its current run of expansion to eleven months. Notably, the headline PMI rose from 55.9 in April to 56.0 in May, to hit the highest level in just over 11 years.

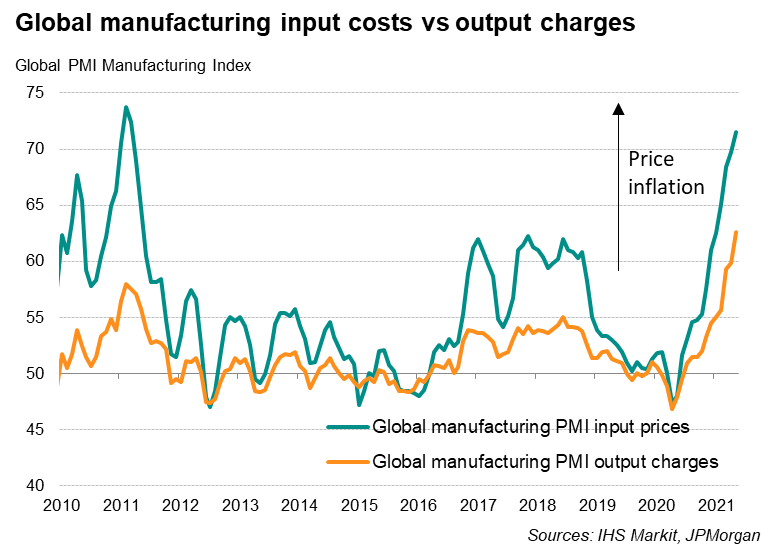

Digging deeper into the data, the PMI sub-indicators tell a familiar story of supply side constraints in May, which continued to contribute to soaring prices. Despite it being more than a year following the initial economic upturn, the hiccups in the recovery persist.

The persistent supply constraints are a phenomenon that continues to elude global markets. Conventional wisdom following the initial COVID-19 related disruption to global supply chains had fuelled expectations that a gradual easing of the bottlenecks with improving COVID-19 conditions and mass inoculations would enable resumption of normal activities. Pent-up demand would subsequently drive the increase in global output.

Although global manufacturing suppliers' delivery times did move closer to stabilisation in mid-2020 to suggest some semblance of easing supply strains, more recent PMI data suggested that lead times lengthened to a degree comparable to the peak of 2020. The consequent impact on prices globally had been one of rising inflation, while the effect on regional performances were mixed.

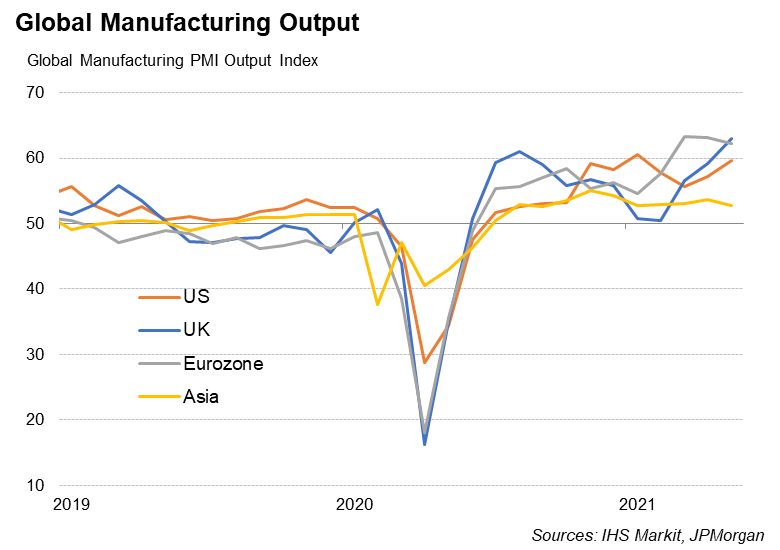

Asian manufacturing output growth lags peers amid supply constraints and COVID-19 drag

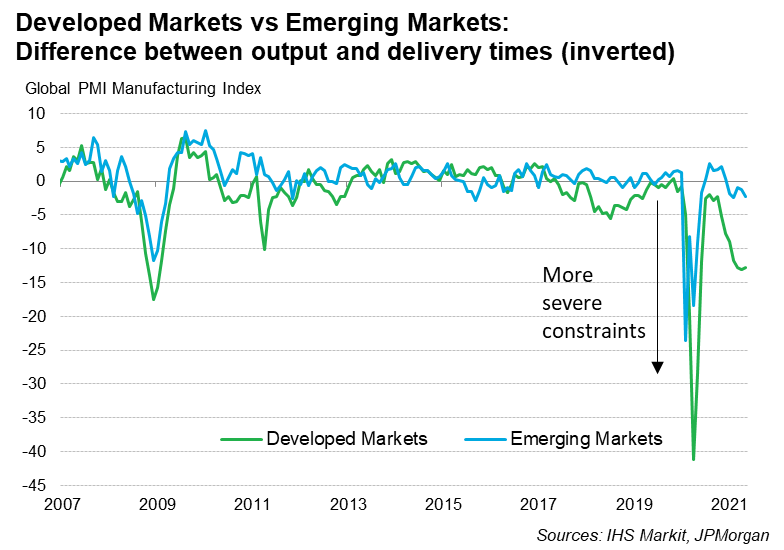

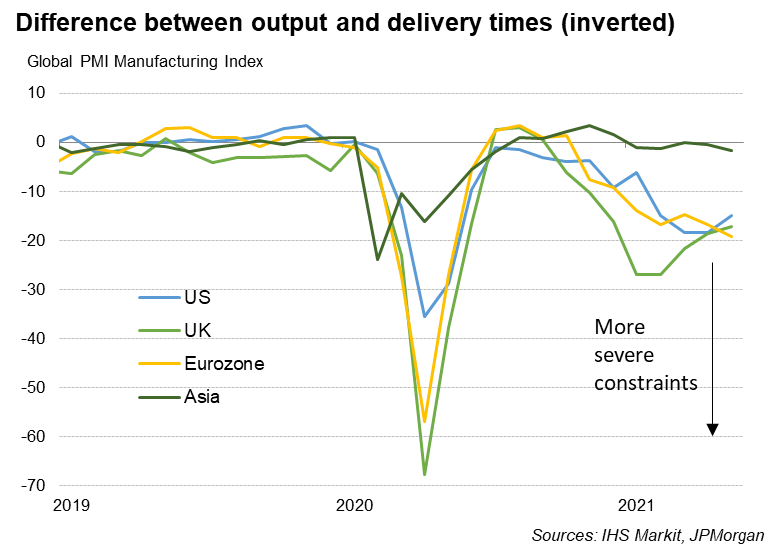

To assess the severity of supply constraints on manufacturing performance, it is useful to consider the difference between output and delivery times sub-indicators. The rate at which delivery times worsened was much faster than which output grew, and this was consistent across both developed and emerging markets. Relative to emerging markets, developed markets experienced more severe conditions.

Drilling deeper into the different regions, one would see the US, UK and eurozone suffering this phenomenon more severely compared to Asia. Contributing to the significant output and delivery times differentials for these key developed economies is relatively stronger output growth and a steeper deterioration in lead times.

The trend beckons one to consider how the recovery path may pan out for Asian economies particularly with the region broadly lagging western peers in terms of recovery momentum.

While US and European economies experienced more severe supply constraints, their output and orders growth were also more spectacular. Going forward, these constraints may act as speed bumps in the recovery from the pandemic, especially after the initial burst of demand from the reopening of economies such as US and Europe.

For Asian markets that had barely started to recover and are finding a resurgence in COVID-19 cases affecting recent manufacturing sector performance, output growth in the region could potentially continue to lag these developed market outperformers. It also leads one to consider the global growth picture without Asia pulling its weight.

Price pressures intensify amid supply and demand imbalance

Inflationary pressures are also a by-product of the economic rebound. The surge in demand alongside the easing of COVID-19 restrictions in many countries while supply lagged has shifted the pricing power to sellers, enabling average input prices to soar. Downstream customers experienced the effects as well with output charges in the manufacturing sector lifted by increasing cost burdens.

As mentioned previously, the perseverance of supply constraints continues to elude global markets. Using the case study of the global semiconductor shortage as an example, the building of new fabrication facilities would take more than a year. Even if current operating capacity were boosted, it is still expected to last years according to Intel CEO Pat Gelsinger in recent interviews.

Likewise for prices, the prolongment of the supply and demand gap could see higher prices starting to stick and would carry with it macroeconomic implications. This is especially important for regions that have yet to see a full-fledged recovery from the pandemic, such as Asia.

Jingyi Pan, Economics Associate Director, IHS Markit

jingyi.pan@ihsmarkit.com

© 2021, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.