Caixin China manufacturing PMI falls to survey low on coronavirus countermeasures

- Output, new orders and employment all drop at survey-record rates

- Supply chains under intense pressure

- Fastest backlog accumulation for nearly 15 years

- Optimism rises to five-year high as firms anticipate output rebound upon restriction rollback

- Recovery may come as soon as March

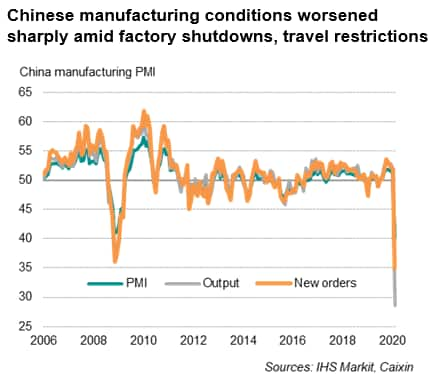

The COVID-19 outbreak had a severe impact on China's manufacturing sector in February due to efforts to contain the spread of the coronavirus, according to the latest Caixin PMI data. Extended Lunar New Year work suspensions and factories operating well below capacity caused production volumes and new order intakes to plunge at survey-record rates. Supply chains were disrupted as a result, causing backlogs of work to accumulate sharply.

The negative effects however are expected to be temporary, with firms anticipating a swift recovery of output once restrictions to halt the spread of the coronavirus are lifted.

Measures severely restrict output

The Caixin headline manufacturing PMI for mainland China, compiled by IHS Markit, dropped from 51.1 in January to 40.3 in February, indicating the sharpest deterioration of the health of the sector since the survey started almost 16 years ago.

With widespread extended factory closures, travel restrictions and resulting shortfalls in labour, manufacturing output fell at the fastest pace since the survey started in early 2004. Lower production was seen across the manufacturing industry, with small- and medium-size enterprises hit particularly hard. However, the output of large manufacturers also suffered. The few firms that reported higher output were often medical equipment producers.

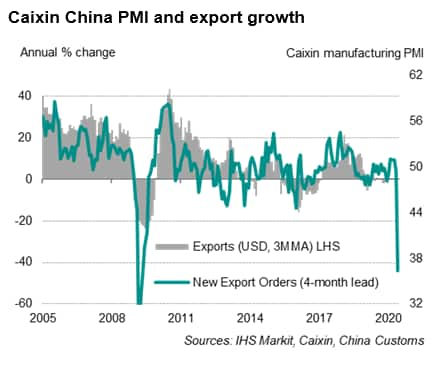

New orders received by Chinese manufacturers also fell sharply, with the rate of decline the steepest in the survey history. Export sales also shrank at a survey-record rate amid constraints on production, shipping restrictions and order cancellations.

Chinese manufacturing conditions worsened sharply amid factory shutdowns, travel restrictions

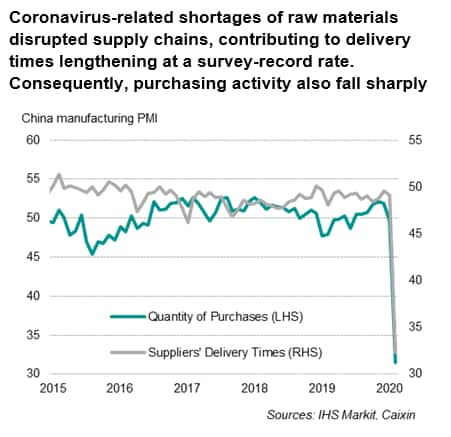

Coronavirus-related shortages of raw materials disrupted supply chains, contributing to delivery times lengthening at a survey-record rate. Consequently, purchasing activity also fall sharply.

Supply chains under intense pressure

Public health measures designed to halt the spread of the coronavirus reportedly led to a severe disruption of supply chains, sharply restricting the availability of inputs to factories. Delivery times lengthened to the greatest degree seen in the series history.

Purchases of inputs by Chinese goods producers consequently fell sharply, as reflected by a survey-record contraction of purchasing activity. Average input cost inflation meanwhile eased from January, linked in part to lower global commodity prices, notably oil.

Recovery may come as soon as March

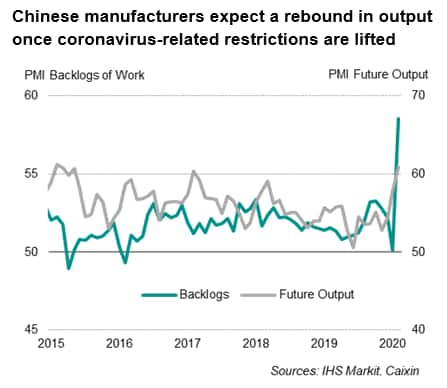

Production halts and severe staff shortages had contributed to intense capacity pressures during February, as signalled by the fastest rate of backlog accumulation for almost 15 years. The timing as to when the coronavirus-related restrictions will be relaxed is critical to restoring China's manufacturing productive capacity - and therefore engendering a recovery.

Encouragingly, panel comments from the survey showed Chinese firms anticipating the difficult situation faced by the sector to be temporary. In fact, the level of confidence, as measured by the Future Output Index, rose to the highest for five years in February. This optimism was supported by positive developments in the last week of February (Caixin PMI data were collected 11-21 Feb)

The final week of February continued to see industrial production resuming, with work resumption rate in large industrial enterprises rising to 77% on national average as of 28 February. Infrastructure projects had also gradually been restarted. That said, restarting work in small firms remained slow-going and generally lagged their larger counterparts. Capital utilisation ratio also stood around 50% due to ongoing shortages of workers and raw materials.

Nevertheless, the current situation is expected to improve as soon as in March with an increasing number of manufacturing enterprises resuming work. Fiscal and financial measures aimed at promoting work resumption amid a tapering off of new reported Covid-19 cases will also support the move towards normalising industrial output levels and construction activities.

Bernard Aw, Principal Economist, IHS Markit

bernard.aw@ihsmarkit.com

© 2020, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.